how to buy tax liens in maricopa county

So its all done in a day or 2. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner.

City Limits Maricopa County Az

A Down Bid Auction.

. Arizona law allows an investor to receive up to 16 interest per annum on. Tax Lien Certificates Yield Great Returns Possible Home Ownership. The lowest bidder is the winning bidder and receives a certificate of purchase for the tax lien.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership. Maricopa County Treasurers Office 301 West Jefferson Room 100.

Interested parties must complete an Unsold Previously Offered Parcel Offer Form PDF and submit this form and payment in cash or guaranteed funds Cashiers Check or Money Order made payable to Maricopa County Treasurer. Purchase requests will be recorded and processed in the order in which they are received. Ad Need Property Records For Properties In Maricopa County.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. In this video learn how to buy tax liens in Maricopa County and find out. How do tax liens work in Arizona.

Think about turning the qualities into leasing properties which provides you with some ongoing income. You may also turn the qualities into companies. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale.

Investors are allowed to bid on each Arizona tax lien. Auction properties are updated daily on Parcel Fair to remove redeemed properties. Please allow 2-3 weeks for the full release to post with the appropriate County Recorders Office andor Secretary of State.

The bidding starts at 16 and goes down from there potentially all the way to 0. With tax lien certificates purchasers are investing their money with Pinal County Arizona and when the Pinal County Arizona Tax Collector collects the past due taxes they send purchasers a check returning what they paid to purchase the Arizona tax lien certificate plus applicable penalties interest andor late fees. Please read the disclaimer before deciding to bid and see our lien FAQ Page and Lien History Page.

Maricopa County Tax Liens If you happen to end up getting some qualities that have not been redeemed by the previous owners you may still come out forward. You can now map search browse tax liens in the Yavapai Coconino Apache and Maricopa 2022 tax auctions. The Maricopa County Arizona Treasurers Office requires that buyers submit a list of the property tax lien certificates they intend to purchase along with a cashiers check money order certified check or wire transfer for the approximate total.

Payment in full with Cash or Certified Funds. Nowadays they do it online. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales.

Find Information On Any Maricopa County Property. The county will make a tax delinquent properties for sale list. That list will be online on the countys website and theyll also publish the list to the local newspapers.

Ad Find Tax Lien Property Under Market Value in Maricopa. Completed forms may be mailed or delivered to. Are you interested in buying tax liens.

4 counties in Arizona have now released their property lists in preparation for the 2022 online tax lien sales. Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent to Release State Tax Lien s. Every one of those certificates on the Maricopa County tax lien list will be auctioned off.

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Do you currently reside in Maricopa County.

Preferred Pricing For Pros The Home Depot Pro How To Get Money Rewards Program Tax Preparation

These Are The Best Places To Retire In 2018 Sun City Arizona Vacation Spots Best Places To Retire

Pin By Breakthrough Design On Thd

Pin On Its All About The Views

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Vintage Advertising For The 1959 Rambler Automobiles In The Arizona Republic Newspaper Phoenix Arizona June 27 1959 Vintage Advertisements Rambler Automobile

Pha Annual Plan 2021 2022 Housing Authority Of Maricopa County

Coverage Area Tts Courier Services

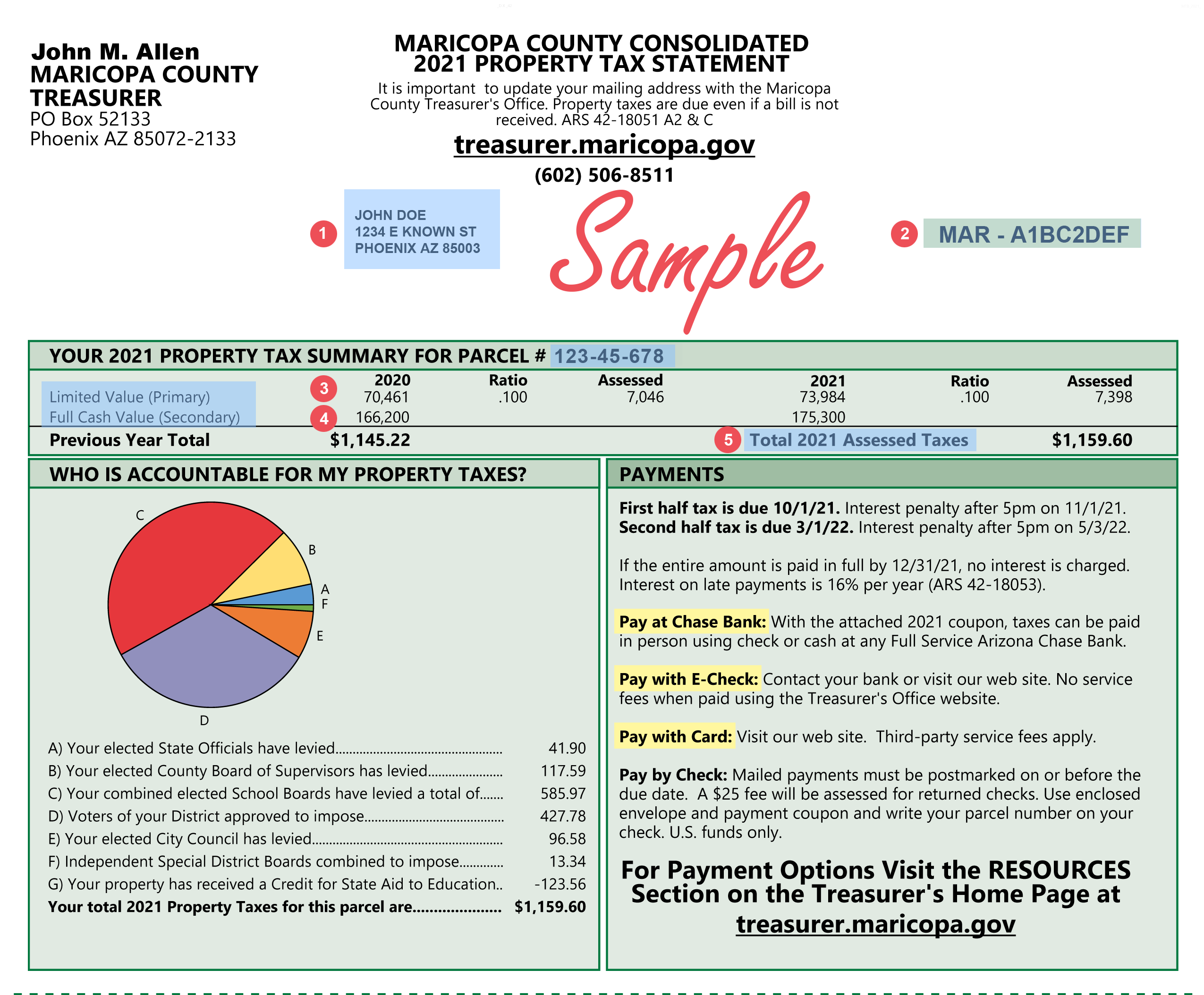

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Https Www Iii Org Article How To Save Money On Your Homeowners Insurance Home Buying Process Home Equity Loan Home Equity

Phoenix Arizona Homes For Sale Landlord Tenant Placement Property Management Services Arizona Being A Landlord Arizona Real Estate Home Buying

1885 Maricopa Hwy Spc 10 Ojai Ca 93023 Realtor Com Oak View Open Floor House Plans Ojai